Deeper dives into prices and worker pay show that the war against inflation is not yet won. There...

Why own TIPS?

This often-misunderstood investment vehicle can add real benefit to portfolios

In an era with renewed concerns about the threat inflation poses to investment returns, Treasury Inflation Protected Securities (TIPS) can offer investors some considerable advantages. But TIPS are commonly misunderstood and therefore often overlooked by investors who could be missing out on the benefits of an investment that offers opportunities for both inflation protection and diversification.

TIPS are in fact just a U.S. Treasury bond with a twist. They pay a lower interest rate, but as the Consumer Price Index (CPI) increases, the investor receives additional shares of the bond (technically an adjustment to the face value). The adjustment provides an extra element of inflation protection that traditional Treasuries lack.

This leaves TIPS with two sources of potential return. The first is from the traditional bond component, in which principal changes and income payments provide returns much like any other bond.

The second source of potential return is from the inflation adjustment component. Because the lower interest rate for TIPS is based on what the market expects to receive in inflation adjustments, the difference in yields between TIPS and Treasuries of the same maturity is a useful way to gauge inflation expectations. TIPS should outperform traditional Treasuries if inflation turns out higher than market expectations and underperform those Treasuries if inflation ends up lower than what the market expected.

For example, if 12-month T-bills have a 5% yield and 12-month TIPS have a 3% yield, we can infer that the market is expecting the CPI component of TIPS to pay 2%. Since TIPS are just Treasuries with an inflation-protected component, the difference in yields reflects the market’s expectations for CPI.

If actual inflation over that 12-month period is higher than the 2% expectation when the investor bought it, then TIPS holders will receive a benefit over holders of Treasuries with the same maturity. If CPI comes in below that 2% expectation, then traditional Treasuries will outperform TIPS. That’s why the difference between yields of traditional Treasuries and TIPS with equivalent maturities is known as the “breakeven” rate.

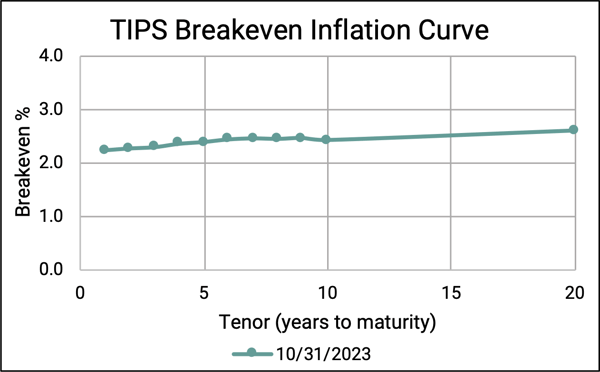

The chart below shows the current breakeven inflation rates for TIPS of different “tenor” (which is a fancy way of saying years-to-maturity) as of the end of October 2023.

Source: Bloomberg.

Notice that the breakeven rates range from 2.23% for the one-year to 2.59% annualized inflation for the 20-year. So, why own TIPS? If CPI over the next year comes in at a level higher than 2.23%, holding the 12-month TIPS will provide an added benefit over just owning a T-bill. So, if an investor thinks the market’s inflation expectations are understated then it could be beneficial to allocate some fixed income holdings to TIPS.

Over the last 3 years, 10 years, and 20 years, the Bloomberg U.S. TIPS Index has outperformed the Bloomberg U.S. Treasury Index. While past performance is not indicative of future results and some of the advantage has been due to the surprise bout of inflation in the past couple years, there’s also an obvious diversification benefit provided by holding TIPS. Inflation is one of the primary risks that investors face in the fixed income portion of their portfolios. Incorporating securities with built-in inflation protection can help bolster a portion of portfolios against that risk.

Incorporating TIPS into your fixed income investments may be an attractive option for diversification and gaining some inflation protection within one of the most inflation-sensitive portions of your portfolio. The Alesco Advisors investment team positions most client portfolios with a portion of their fixed income holdings in low-cost TIPS funds to reap the potential benefits that these securities can offer.

The content in this blog post is provided for informational purposes only, and should not be construed as personalized investment advice. The data and information used in the preparation of this blog post are obtained from third-party sources believed to be reliable, but Alesco Advisors does not guarantee the accuracy, completeness, or timeliness of the data and information. Investing involves risk and there are no guarantees that any investment strategy will be successful or that any securities mentioned in this communication will achieve their objectives.

-1.png?width=50&name=Untitled%20design%20(32)-1.png)

.png?height=200&name=inflation%20(300%20%C3%97%20175%20px).png)