When it comes to achieving financial security and preparing for a comfortable retirement, a...

Investing without borders

International markets offer enhanced diversification in a well-balanced portfolio

Diversification within a portfolio has become conventional wisdom for disciplined investors seeking to benefit from participation in capital markets. By not placing all our eggs in one basket, we reduce the risk of losses from exposure to a single asset and increase the opportunity to capture returns from a variety of sources.

Investors often think of diversification being achieved by selecting a combination of assets representing different sectors, sizes, and styles from across the economy. But those seeking an additional way to diversify should also look beyond our borders to international investments.

Investing in international markets offers diversification advantages on multiple levels. Holding foreign equities can help investors reduce risks linked to exclusively investing in the domestic market. Despite the United States' dominant economic position, it still faces political and policy risks unique to the country. As all markets carry risks related to their respective governments, enhancing geographic diversification can effectively distribute these risks more broadly.

International investments also help provide exposure to different sectors and companies. Even if some sectors are nominally the same as those offered within the U.S., the characteristics of those in other countries might look markedly different. Foreign sectors or companies might have stronger growth prospects or more attractive valuations than their domestic counterparts, and they’re also subject to different economic cycles within their home country. For example, the companies in the MSCI EAFE Index have been able to grow their earnings faster than companies in the S&P 500 Index for the 12 months ended March 31, 2023. At the very least, international investments provide more sectors and companies that domestic investors may use to diversify.

Investing internationally also adds an important new dimension to the typical risk-reward equation—currency exchange. Shares of companies listed on stock exchanges outside the U.S. are traded in the currency where the exchange is located. So, investors outside that country must exchange their own currencies to purchase shares. The value of any foreign asset is then ultimately dependent on both the listed price as well as the currency exchange rate. Investors encounter this first when buying an asset, then again when the time comes to sell and convert the proceeds into their home currency. The relative value of currencies fluctuates over time, adding a new dimension to consider when determining the potential returns of foreign assets.

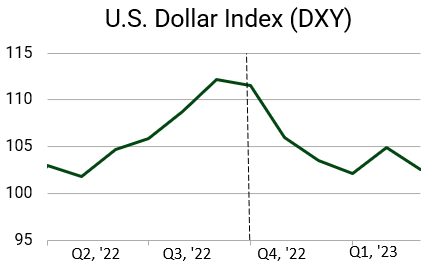

The past year presents a particularly helpful example of how this works. The following chart shows changes in the value of the dollar compared to a basket of international currencies from the second quarter of 2022 (Q2 ’22) though the first quarter of 2023 (Q1 ’23).

Source: Bloomberg; DXY measures the value of the dollar against a basket of its most important trading partners.

The green line shows the relative value of the dollar increasing over the second and third quarters of 2022, then falling over the next two quarters. This change had consequences for U.S. investors who held international investments during that time, as the price of those assets fluctuated along with the relative value of the dollar.

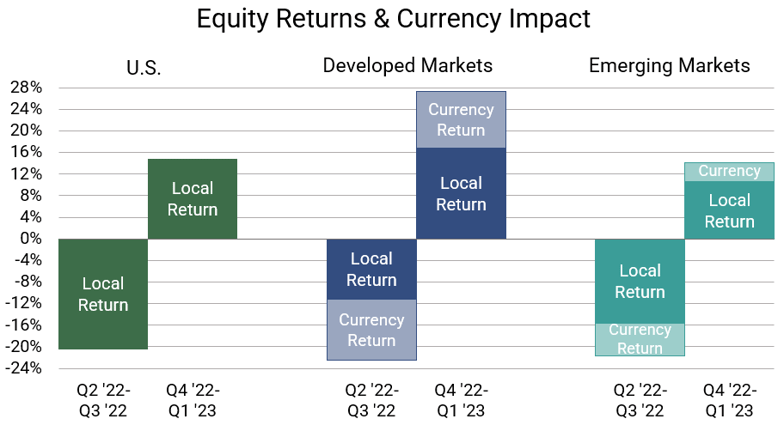

The chart below gives a visual representation of returns over the past year for U.S., developed international markets, and emerging international markets, broken down between the second and third quarters of 2022 versus the fourth quarter of 2022 and first quarter of 2023.

Source: Bloomberg. Russell 3000, MSCI EAFE USD, MSCI EAFE Local, MSCI EM USD, and MSCI EM Local. Currency impacts estimated as difference between USD and Local index returns.

An investor holding dollars and investing only in the U.S. stock market would have seen their portfolio drop over 20% during the second and third quarters of 2022 and then rebound over the following two quarters by nearly 15%. Without the need to exchange currency for these investments, the returns are purely “local” and based only on the changing price of the assets.

If an investor held developed market assets during the second and third quarters of 2022, those investments would have fallen in price by around 11%. But a U.S. investor who purchased those assets by exchanging their dollars for the foreign currency would have seen the value of those investments fall another 11% due to the rising value of the dollar against foreign currencies during that time. On the flip side, over the following two quarters, those assets would have risen over 16% in price, and the reversing trend of the dollar would have added another 10% of currency return. The story with currency returns in emerging market investments reflects a similar but less pronounced effect to that seen in developed markets over those same time periods.

Expanding into international markets is an attractive option for diversifying your portfolio and gaining currency exposure. The relatively recent proliferation of low-cost mutual funds and ETFs that track all kinds of indexes—including a variety of international markets—has made it more affordable and easier to access these opportunities. The Alesco Advisors investment team recommends most investors maintain a portion of their equity holdings in low-cost international funds to reap the potential benefits that international diversification can offer.

-1.png?width=50&name=Untitled%20design%20(32)-1.png)

.png?height=200&name=financial%20planning%20(1).png)

.png?width=50&name=Justin%20(2).png)

.png?height=200&name=dollar%20is%20on%20euro%20trip%20(300%20%C3%97%20175%20px).png)