When most investors think about risk management, concepts such as volatility or capital loss...

The hidden risk of “risk-free” Treasuries

While short-term government debt may offer attractive returns today, piling into T-bills could be a mistake

Rates on short-term debt are up to some of the highest levels in years. For investors seeking to take advantage of this opportunity, short-term Treasury bills maturing within the next year have drawn much attention. These securities, often referred to as “risk-free” due to the high unlikelihood of government default, are currently yielding over 5% return on investment. So, for investors considering how to position the fixed income portion of their portfolios, doesn’t the choice seem obvious?

It might seem like a no-brainer to simply pile fixed income investments into short-term treasuries, but that could be a mistake for two reasons. First, the term “risk-free” is misleading as there are risks beyond a borrower-default for investors to consider. And second, other investments have also become attractive in the current environment and need to be considered as relevant options.

Reinvestment risk

Over time, interest rates fluctuate in the market. When a bond comes due and the principal is returned, there is a risk that the investor may not be able to reinvest at an equally attractive rate as before. This is important, as right now the highest rates are being paid on bonds with the shortest maturities. If a long-term investor decides to allocate their fixed income investments to bonds with short maturities, they will be required to reinvest the principal on a more frequent basis, making them more subject to changes in market rates that happen over time.

A 5% annualized return on a bond with almost no risk of default is an attractive opportunity, no doubt. But the short-term nature of the bonds offering these rates means that investors today will be exposed to reinvestment risk in the future. Markets are hoping for the Fed to pull off a “soft landing”, with inflation gradually moving down to target levels without the economy suffering a major downturn. But if the Fed winds up over-tightening and the economy takes a sudden turn for the worse, policymakers are likely to cut rates quickly. Holders of short-term debt will then be left to reinvest their returns in a lower interest rate environment that will be far less attractive than before. In short, the party will be over. So, what’s an investor to do?

Returns across the curve

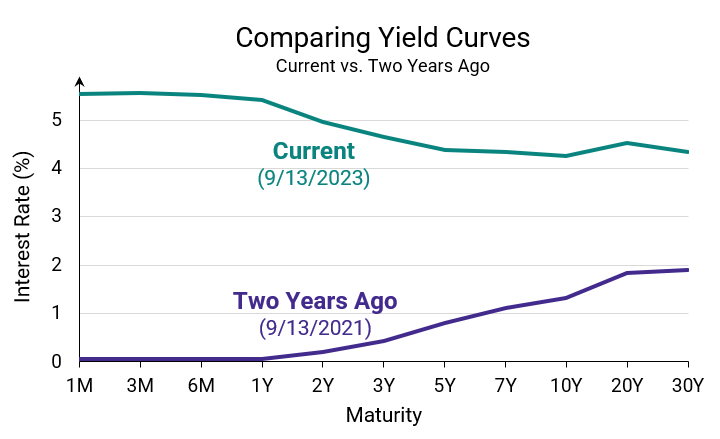

While the returns offered on short-term Treasury bills today are appealing, longer-term debt is also paying a premium over the recent past. Treasury notes and bonds maturing up to 30 years from now are all paying over 4%, which is more than double the returns offered two years ago (and not much lower than what their T-bill cousins are offering).

The chart below shows the U.S. Treasury yield curve compared to what it looked like two years ago. The teal line represents yields offered on treasuries of different maturities on September 13th, 2023, and the purple line shows yields from September 13th, 2021.

Source: www.ustreasuryyieldcurve.com; curves represent yields for U.S. treasuries at stated maturities from dates listed above

The advantage of these longer-term securities is that investor returns are “locked in” for longer. If interest rates were to fall in the future, investors with Treasury notes and bonds would continue to earn the higher rate of return for as long as they held the security.

The risk at the longer end of the yield curve is that interest rates climb even higher and investors are stuck with rates that aren’t as attractive. But with the core inflation trending steadily downward, the Fed has indicated that it is likely near the end of its current rate hike cycle. Uncertainty still exists, but market indicators show that investors think the increases in rates are likely close to over. Even if the Fed were to avoid a recession, normalization of the economic environment may lead to at least some rate cuts.

Our take on bonds

No one knows for sure what will happen with interest rates in the future. Short-term yields are remarkably attractive compared to the recent past, but so too are long-term yields. Treasury bills can be an excellent solution for some short-term cash needs. However, long-term investors would be wise to spread out risk and enjoy the benefits offered across the curve by buying and holding fixed income securities with a variety of maturities.

Up until recently, the Alesco Advisors investment team had been investing the fixed income portions of most client portfolios at a slightly shorter duration than the market as a whole. But given what the data has indicated about the risk and return characteristics across the curve, we recently adjusted most client holdings to align closely to the duration of the entire bond market. In doing so, we have exposed client holdings to the potential benefits offered on bonds of a variety of maturities, both short-term and long-term, while decreasing reinvestment risk.

Despite near-term uncertainty in the market, the long-term outlook for holding bonds as part of a diversified portfolio is strong. Investors should review their circumstances with an investment professional to develop an appropriate plan for how bonds may fit in their portfolio.

The content in this blog post is provided for informational purposes only, and should not be construed as personalized investment advice. The data and information used in the preparation of this blog post are obtained from third-party sources believed to be reliable, but Alesco Advisors does not guarantee the accuracy, completeness, or timeliness of the data and information.

-1.png?width=50&name=Untitled%20design%20(32)-1.png)