Misunderstandings about the relationship between stocks and the economy need to be cleared up. The...

The Social Media Effect: Unraveling the Spending Habits of Millennials

There is more to the spending habits of millennials, and it goes beyond avocado toast

Millennials are often portrayed in the media as financially irresponsible and frivolous spenders. However, such generalizations overlook the unique economic challenges faced by this generation and the influence of social media on their financial behaviors.

Key economic factors, such as mounting student loan debt, stagnant wages, and the effects of two major financial crises within the last 20 years, have significantly impacted millennials' pursuit of financial security. While stagnant wages might seem counterintuitive based on the recent wage increases across U.S. consumers, studies show that millennials are earning less than previous generations at the same stage of life. Consequently, these challenges have delayed significant life events such as marriage, starting a family, and homeownership.

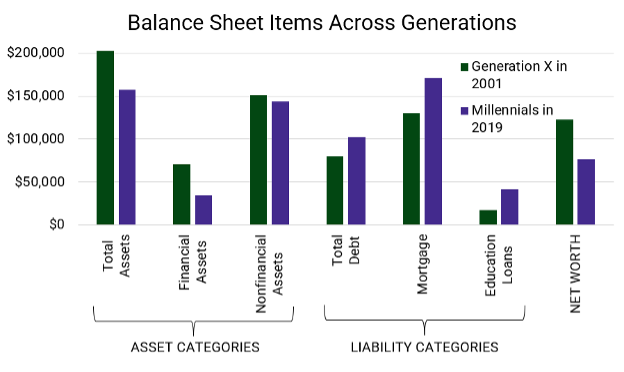

Source: Survey of Consumer Finances, Board of Governors of the Federal Reserve System. The most recent survey data available are as of 2019. Data are for the average household with a head between ages 18 and 35 in 2019 (approximate Millennials) and in 2001 (approximate Gen Xers). The chart displays total assets along with select asset categories, total liabilities along with select liability categories, and net worth which is total assets minus total liabilities. The data are adjusted for inflation, with dollar values reflecting in the equivalent of 2019 prices.

According to the latest survey data available, when comparing millennials in their 20s and early 30s to Gen Xers at the same life stage, there are notable differences in their financial standings. Inflation-adjusted figures reveal that Gen Xers had higher asset totals, lower levels of debt, and significantly higher net worth than millennials. This highlights the contrasting financial situations between the two generations during this pivotal phase of life.

Amidst these economic challenges, social media has emerged as a significant influencer (pardon the pun). Millennials' constant exposure to peers' lives has altered their spending patterns, pressuring them to emulate certain experiences, which impacts real spending.

Life events like marriage and home-buying, prevalent in millennials' current life stage, have evolved under this influence. The cost of weddings has risen, reflecting not only inflation but the desire to recreate grand celebrations seen online. Similarly, first-time homebuyers face dual pressures of escalating housing costs and a heightened sense of urgency to match peers' achievements, often leading to hasty decisions and higher expenses.

The cost of child-rearing has seen a significant increase. According to Brookings, the total average cost of raising a child from birth through age 17 was $284,594 in 2017. However, in 2022, that amount rose by $26,011 to reach $310,605. Parents face the added strain of fulfilling expectations influenced by social media to provide experiences or material possessions for their children.

Despite a temporary pandemic-induced dip, consumer spending has steadily climbed since the 1950s. Social media's influence on this trend cannot be overlooked, even though its full impact on consumer behavior remains to be fully understood.

Alesco Advisors recognizes that each generation has its own distinct investment challenges. We believe in the power of comprehensive planning and robust investment theory not only as wealth management tools but as guiding lights that can assist families across generations. Our aim is to provide our clients with sharp insights, enabling them to confidently navigate complex financial landscapes, make informed decisions, and effectively respond to the myriad external influences shaping our society.

.png?width=50&name=Justin%20(1).png)

.png?height=200&name=economy%20(300%20%C3%97%20175%20px).png)

-1.png?width=50&name=Untitled%20design%20(32)-1.png)

.png?width=50&name=Tim%20(1).png)

.png?width=50&name=Justin%20(3).png)