Worries about a looming economic downturn persist—what’s an investor to do?

The double downgrade

Recent downgrades by credit ratings agencies merit a closer look before sounding another alarm

Headlines were made in the financial news recently by two separate downgrades from major credit ratings agencies. On August 1st, Fitch downgraded U.S. government debt one level from its top rating. The following week, Moody’s downgraded the credit rating of 10 banks that have been struggling amid a higher-interest rate environment. Let’s dig into what this might mean for investors and the market.

It’s important to start by clarifying what exactly a credit rating is. Three large credit ratings agencies—Moody’s, Fitch, and Standard & Poor’s (S&P) – publish ratings on a wide range of bonds issued by organizations such as corporations and governments. The purpose of these ratings is to give investors an idea about the credibility of bond issuers as borrowers.

These ratings can be a helpful tool for investors to gauge risk—the lower the credit rating, the higher the potential risk. So, it stands to reason that any change in a credit rating that is new or surprising might seem to be a significant event that may give investors cause for reconsidering the riskiness of their current holdings or potential investments.

But rather than the ratings themselves, it’s actually the information that ratings agencies use to make their determinations that really matters most to markets. And in the case of both of the recent headline-making downgrades, that information should be neither new nor surprising to investors.

Take Fitch’s rationale for downgrading U.S. government debt: the agency stated that a major cause for its downgrade was the debt ceiling debate from May and June. The tension from that situation was widely reported and commented on (The Waterwheel spilled ink on the topic back in June), and the Treasury market experienced relative volatility as investors processed the information in real-time.

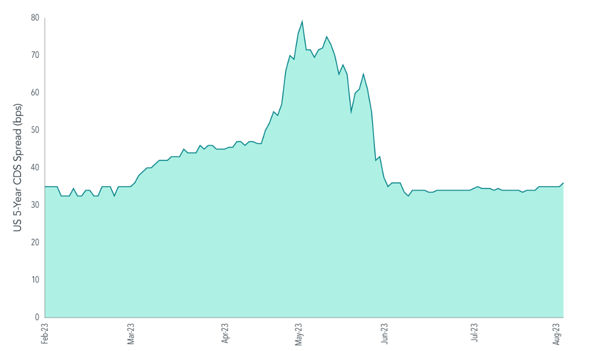

The chart below from Dimensional Fund Advisors shows credit default swap spreads for five-year U.S. Treasuries from February to August 2023, which reflect the cost of insuring against the federal government defaulting on its debt. This market-based measure is a helpful real-time gauge of investor worries, as higher spreads indicate increased demand for insurance against default.

Credit Default Swap Spreads for Five-Year U.S. Treasuries

Source: Dimensional Fund Advisors, Bloomberg.

Notice the demand for insurance against a government default began to creep higher in March and April as the debt ceiling debate ensued, then shot higher in May as the situation became more acute. By the first week of June, when it became clear a deal would be reached, demand for this insurance fell off to more typical levels.

The data in the graph also covers the days shortly after Fitch’s downgrade in early August, with the measure ticking only slightly higher after the downgrade was announced. While interest rates did fluctuate around that time, investor demand for insurance against default barely budged. The market essentially indicated that Fitch’s downgrade is old news. Ratings agencies have the same access to data as the market, so investors processed this information in real-time a few months ago while Fitch took a few months to finalize its downgrade.

The lag in Fitch’s downgrade doesn’t make it irrelevant. The debt ceiling debate was worrisome and reflects poorly on the politicians currently in charge of the federal government’s fiscal future. But the market didn’t need a ratings agency to tell it that—investors react to information in real-time, so live pricing is a better indicator of the market than a report from Fitch.

Credit ratings agency downgrades are also no crystal ball for the future. S&P downgraded U.S. debt back in 2011, causing many to fear that the higher costs of borrowing for the federal government would be imminent. Instead, the decade that followed saw some of the lowest interest rates on Treasuries in history. Simply put, there are many more factors than an agency’s credit rating that determine the cost of borrowing for the U.S. government.

The same can be said for the group of banks that have been downgraded. Markets reacted to the balance sheet issues of these banks in real-time as the information emerged in March 2023 (The Waterwheel weighed-in on this back in March). The Moody’s downgrade happened months later, using past data to build its case for a lower credit rating. The issues of small and regional banks have been troubling, but the downgrade hardly represents something new or surprising for bond market investors.

In fact, regulators have had time to propose a plan for higher capital requirements to be imposed on mid-sized banks. While this might constrain the ability of these banks to turn high profits (which could be troubling for shareholders in those banks’ stocks), these new regulations would actually help to ensure the solvency of the affected banks making them more credible borrowers. Again, there are many factors beyond credit agency ratings that determine the risk of lending and cost of borrowing.

Risk is an inherent part of investing, and the recent headline-making credit downgrades are a reminder of exactly that. But while credit ratings are important, they are also only one piece of the risk assessment puzzle. The Alesco Advisors portfolio management team relies a disciplined process to assess a broad array of risks on an ongoing basis in order to effectively manage investments for our clients.

Creating portfolios that manage risk in a manner that reflects the objectives of our clients is at the heart of our investment process. The most important thing we can do for our clients is to continue managing risk using a disciplined approach that best positions investors for what might lie ahead.

The content in this blog post is provided for informational purposes only, and should not be construed as personalized investment advice. The data and information used in the preparation of this blog post are obtained from third-party sources believed to be reliable, but Alesco Advisors does not guarantee the accuracy, completeness, or timeliness of the data and information. Past performance is not indicative of future results

-1.png?width=50&name=Untitled%20design%20(32)-1.png)

.png?height=200&name=dollar%20(300%20%C3%97%20175%20px).png)

.png?height=200&name=economy%20(300%20%C3%97%20175%20px).png)