On March 15, 2020, the Federal Reserve made its largest emergency cut to interest rates in its more than 100-year history, slashing the federal funds rate by 1.00 percent. Questions remain as to whether this is the bottom of a more than 30-year decline in interest rates, and moreover, will interest rates dip to negative territory?

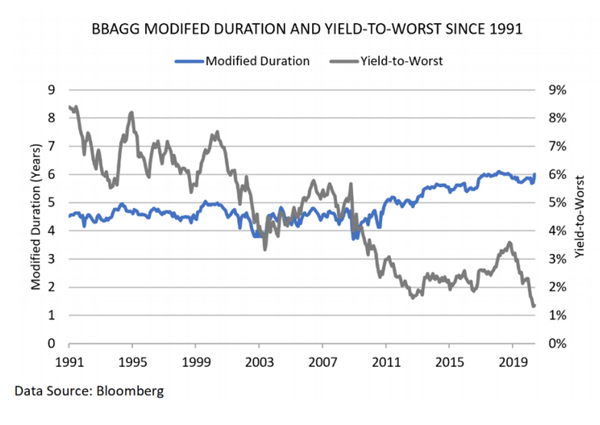

Using the Bloomberg Barclay’s Aggregate Bond Index as a proxy for the total bond market, we can observe the decline in interest rates since 1991, as well as an increase in modified duration (interest-rate risk) over the same period. All else being equal, bonds with higher duration have greater price volatility compared to bonds with lower duration. Simply put, fixed income investors today are taking on more risk with significantly lower return potential.

As a fiduciary, what steps can be taken to successfully navigate this low-interest-rate environment?

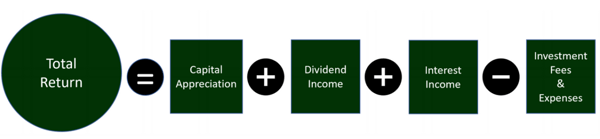

Assuming a blended portfolio of stocks and bonds, an investment portfolio’s total return is comprised of the following components:

With the potency of the interest-income component of the total return equation weakening due to the low-interest-rate environment, coupled with the heightened risk in the bond market as a result of increased duration, now is a prudent time for fiduciaries to revisit their portfolio’s investment and spending policies.

Step 1: Review your Investment Policy

The investment policy is the guiding plan for managing an organization’s investment portfolio. It should be aligned with the overarching mission of the organization and its ongoing operational needs. The policy sets forth the parameters for an investment portfolio’s strategic asset allocation, thus outlining the expected levels of risk and return from the portfolio.

Given current market conditions, fiduciaries should consider revisiting their investment policy and determine what actions, if any, may be taken to provide the investment portfolio the best chance at success in the future. Consult with your investment committee, advisor, consultant, or outsourced chief investment officer (OCIO) for further guidance.

Step 2: Review your Investment Portfolio’s Spending Policy

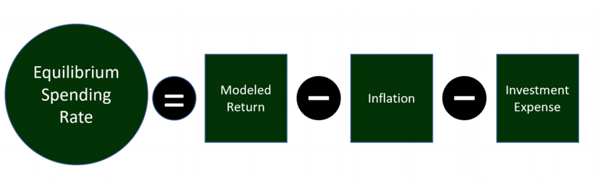

Fiduciaries have a responsibility to make prudent spending decisions. To do so requires an appreciation for the components of a portfolio’s equilibrium spending rate (amount that can be spent without eroding principal). Below is a quick refresher on how to compute a portfolio’s equilibrium spending rate:

There are two ways a fiduciary can affect the equilibrium spending rate. First, within the parameters of the investment policy, the fiduciary can adjust the portfolio’s modeled return by modifying the portfolio’s asset allocation. And second, often times investment expenses can be materially reduced.

In today’s historically low-interest-rate environment, keeping investment expenses to a minimum is a key component of an investment steward’s fiduciary responsibility. Expenses can easily erode a portfolio’s returns over time and are obviously part of the equation to effectively manage a portfolio. Fiduciaries should understand the total expense ratio of the funds they monitor. Moreover, they should look for opportunities to reduce those expenses.

Along with the 30-year decline in interest rates, we have seen an industry-wide decline in investment related expenses. The following publication from the Investment Company Institute in March of 2019, details the decline in investment expenses from the late 1990s through the end of 2018: Trends in the Expenses and Fees of Funds, 2018.

In summary, as a fiduciary, if you are questioning the future viability of your organization’s investment portfolio, especially during these uncertain times, consider contacting Alesco Advisors for an investment perspective that over 100 nonprofit organizations have come to trust.

Visit us today at www.alescoadvisors.com or give us a call at 585-586-0970 to learn more.