Households are rearranging their budgets, which matters for the economy.

- Consumer spending has recovered to pre-pandemic levels, but there’s more to the story.

- Differences in spending on goods versus services reveal an important economic trend.

- The winners and losers are clear, but what does it mean for the economy as a whole?

Consumer spending is back on track, but there’s more to it than that.

There’s no shortage of headlines about the U.S. economy lately. But an interesting and important trend in consumer spending is occurring without much attention.

Consumer spending is a big deal because it typically accounts for two-thirds of overall economic activity—it’s the primary driver of our economy.

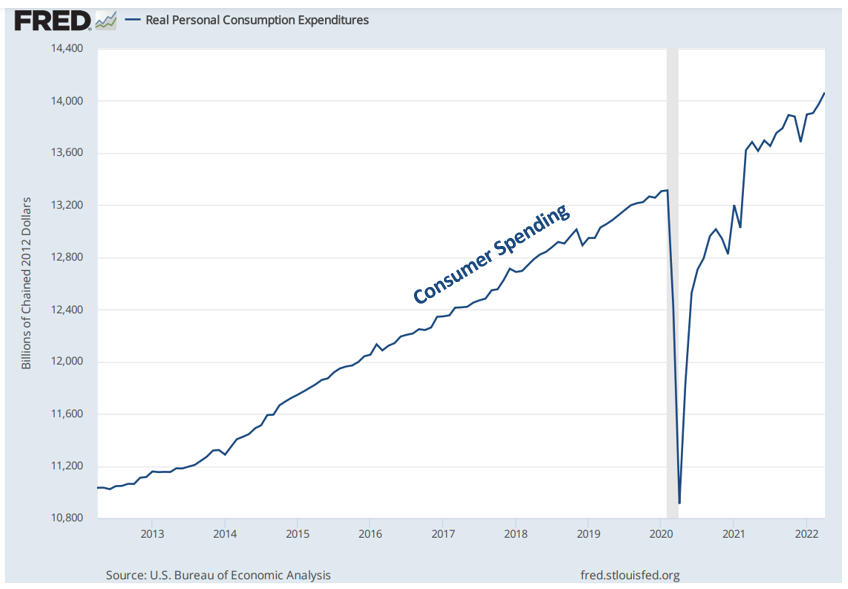

The chart below shows consumer spending adjusted for inflation, which puts past price levels in real context for comparing over time.

The blue line above shows that consumer spending has rebounded from its historic pandemic plunge despite the pressure current inflation is putting on pocketbooks.

But while overall spending is back on track, there’s more to the story. We need to examine how consumers spend their money.

In recent times, consumers have typically spent two-thirds of their budgets on services like healthcare, rent and utilities, insurance, restaurant meals, and recreation activities, among others.

The remaining one-third of household spending is directed toward goods like groceries, fuel, new cars, furniture, appliances, and clothes.

When breaking consumer spending down to the individual categories of goods and services, the tale of the tape shows two remarkably different experiences. And this difference matters.

The stories of spending on goods and services have been very different. It matters.

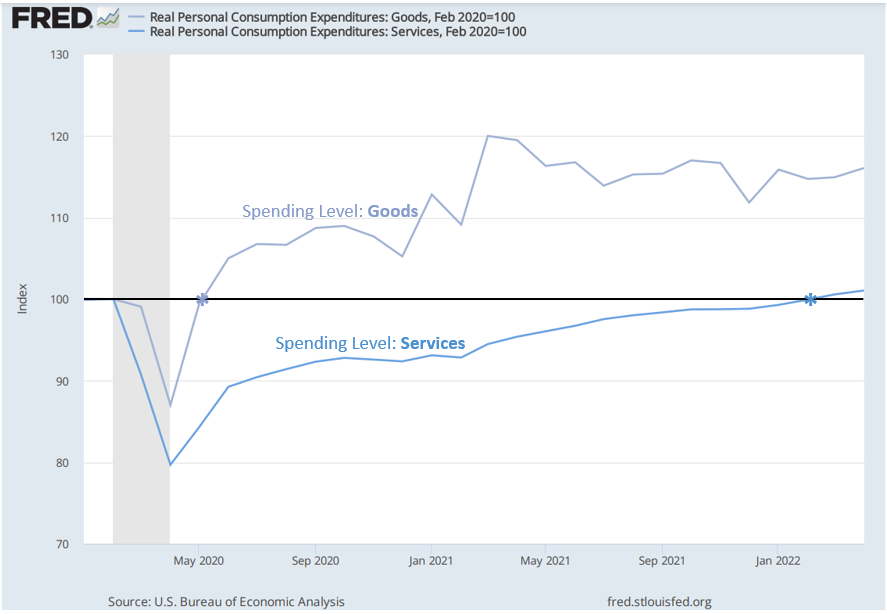

The chart below shows how consumer spending on goods and services changed from pre-pandemic levels. The black line represents spending levels from just before the pandemic shutdowns, and the data are adjusted for inflation.

The story is a familiar one: spending on goods and services took an initial plunge due to the physical restrictions of a locked-down economy and the heightened uncertainty that accompanied it.

Armed with extra cash from personal savings, stimulus checks, and unemployment bonuses, consumers were eager to spend once the “new normal” set in. But ongoing restrictions led new spending to skew toward goods like furniture and laptops, and away from services like plane tickets and eating out.

The purple line in the chart above shows spending on goods compared to pre-pandemic levels. Shortly after the initial plunge, spending on goods recovered to pre-pandemic levels by May of 2020 and continued to climb to record highs the following year.

The blue line in the chart shows spending on services, which took an initial dive and continued to lag for almost two years. Consumers only recently resumed spending on services at pre-pandemic levels as of February 2022.

But this last point might be the most important: spending on services is back now and higher than ever. And while purchases of goods are higher than before, they’ve been largely flat over the past year. This trend has significant implications for the U.S. economy.

The winners and losers are clear. But what does it mean for the future?

Given the important role consumer spending plays in the economy, trends like this are important for everybody. So what does it all mean?

For one, there are clear winners and losers in this case. Service industries like travel and entertainment that had been hampered by the lingering effects of pandemic spending are now reaping the benefits.

And industries that focus on selling goods are beginning to see the signs of struggle. Target made news recently when it warned investors about lower profits due to an excess of unwanted goods. Other notable names in retail such as Macy’s and Gap shared similar reports.

New data support a broader pullback in retail spending, with the Commerce Department reporting a decline in retail spending from April to May 2022. Whether this is a one-time phenomenon or a harbinger of things to come remains to be seen.

There’s also some debate as to how this trend might impact the current inflation situation. An excess of goods typically leads to discounting prices to clear inventory, so might we see some prices drop in the future?

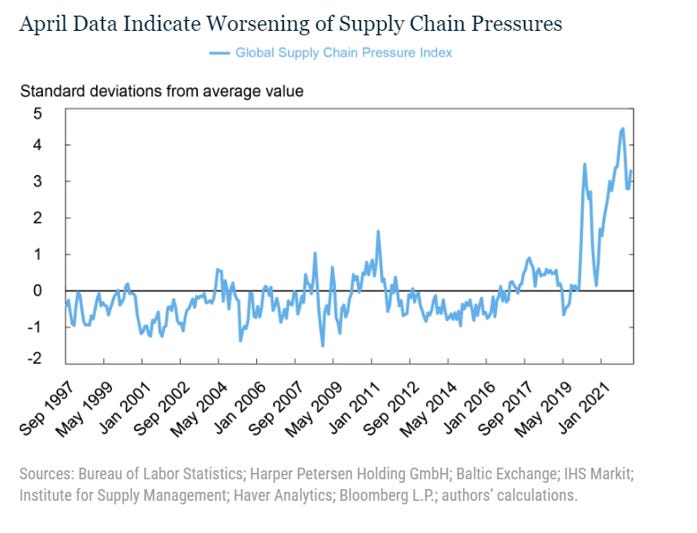

It’s doubtful that lower retail prices alone will put much of a dent in the widespread inflation of today. The global supply chain issues that are the primary culprit of recent price surges have shown few signs of letting up. See the chart from the Fed below:

Factors such as inflation, interest rate hikes, and changes in consumer confidence could all influence how households direct their future spending on goods and services, which creates some uncertainty.

And these trends in consumer spending could create ripple effects that lead to more economic impacts which are yet to be seen.

Stay tuned, more to come.